As I write this, Gamestop stock ($GME) is currently topping $500 a share. Up 25x (2500%) in about 12 days. From The Wallstreet Journal to Bloomberg and The Financial Times, a news article is being written on the subject every 20 minutes. A lot of people are making a lot of money and a lot of people are also losing a lot of money. A subreddit of a couple hundred thousand normal traders almost took down Melvin Capital as it lost billions of dollars. It’s a financial extreme that is actually very fascinating, and pretty simple.

The Short Squeeze

The markets have taught us that there’s always a way to make money. Even in the worst of times (2008 financial crisis and 2020 pandemic March lows), someone is winning. The Big Short is the story of 3 groups of traders that discovered the housing bubble and were able to short the very complicated debt instruments that were propping up this market. Here’s a great video on that. As for 2020 March lows, Billionaire investor Bill Ackman had a hedge win him $2.6 Billion as the market was crashing. In an open market, you should be free to make any bets you want so betting against the market is objectively a smart move in bad times. However, with every bet comes risk. Finance 101 teaches you this on the first day - you can lose money.

Before we dive into the craziness of the past week, we need to understand what the two bets above have in common. They both bet on the downside:

Short Position = borrowing money against a stock. You ask your friend for a couple of shares, you sell them, keep the money for whatever you want, then come back in a month and give him back the shares. Hopefully, the shares will be lower in price, so you can keep the difference and make some money. You’re betting on the price to go down.

Short Squeeze = a short is like a debt contract, and some contracts have specific rules on the interest you have to pay, potential coverages if the loan gets too high, and a bunch more. Sometimes the stock you borrowed goes up. If you’re short the stock, you owe money. As long as the price goes up, you have to buy back the shares at even higher prices. This causes a squeeze, where the price shoots up exponentially to infinity.

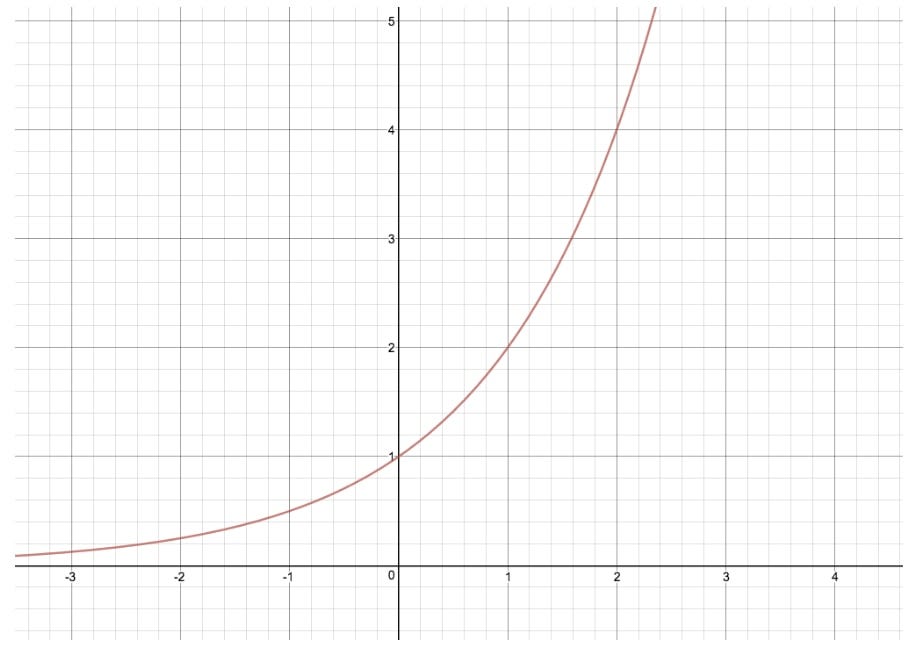

The short squeeze is actually just math. Remember the logarithmic function?

Here’s a picture of Gamestop stock in the past month:

They’re the same.

Theoretically, it’s a good idea to short stocks like Gamestop and AMC Theaters because we’re in a pandemic. Gamestop is a physical store and that’s not a thing anymore. Theaters are closed until further notice and it’s nearly been a year, so AMC is making nothing. Two failing companies with perfect short opportunities. Then there’s WallstreetBets.

WSB

On Reddit, there’s a subreddit called r/wallstreetbets which is a community of people spewing trade advice on posts. I’ve been reading this subreddit since 2018. There are a lot of good traders, a lot of bad traders, a lot of trolls, and a lot of money. It’s just a group of people talking about finance and markets. Here’s an excerpt from a great article on the Verge:

Currently, many people are at home and bored, and consequently, interest in day trading has shot through the roof. There is a Reddit forum for this, r/WallStreetBets, which describes itself as being “like 4chan found a Bloomberg Terminal.” A year ago, a user called delaneydi argued that GameStop was underpriced by the market. For a while, the idea that r/WallStreetBets would take over GameStop was a joke — but then it turned serious, Bloomberg reported. The idea was to punish short-sellers, and for the little guys to pummel Wall Street.

If you think GameStop will fail and the stock will go down, or even that the company will go bankrupt, there’s a way to make money on that. Typically, this is done by short selling — a practice where you borrow shares for a fee and sell them for (ideally) a high price, then buy them back at (ideally) a lower price to return them. This can make you a lot of money, especially if the company goes bankrupt and you don’t have to return the stock!

The thing about short selling, though, is that you lose money if the stock goes up, and your losses are potentially infinite if the stock keeps going up. There are several other bad things that can also happen, such as an increase in fees or the original investor wanting their stock back. This means some shorts will be forced to “cover,” or buy the stock back at a high price, which sends the price even higher.

This community of traders banded together to pump a shorted stock forcing it to skyrocket.

Front-Running

Robinhood offers no-fee trading at no cost. Their sources of revenue come from 3 places:

Robinhood Gold = subscription service that offers more information and different benefits to users.

Interest off Margin = you can trade on margin, which is just taking a loan to have more money, and you just have to pay the interest.

Selling order flow = this is the big moneymaker, and the most questionable. Robinhood sells their order flow, which is a list of all the orders users make to buy and sell a stock, to big player institutional traders for millions.

Why do traders want order flow data? Let the Verge explain:

What does Robinhood have to do with this? Well, it makes options trading much more accessible to retail investors — but there’s something else. Trades on Robinhood are free! But Robinhood isn’t offering free trades to be nice; the company gets paid by some big-time investors such as Citadel Securities to see what retail investors are doing. This phenomenon, which other brokerages are engaged in as well, is called payment for order flow. Citadel Securities makes its money on these orders by “automatically taking the other side of the order, then returning to the market to flip the trade. It pockets the difference between the price to buy and sell, known as the spread,” according to the Financial Times.

The argument in favor of this practice is, essentially, retail investors get better prices than they would on the open market, Bloomberg’s Levine writes. The practice is controversial, though, because some critics say it harms investors. It’s theoretically possible to “‘front run’ orders by, for example, jumping ahead of a customer’s stock purchase to buy it themselves, making a small gain if the share price increases,” the Financial Times explains. “There is no suggestion that Citadel Securities engages in such activity, which is prohibited by SEC.”

So technically this method is illegal. But we don’t know what they don’t know. Basically, they’re innocent until proven guilty, but in any case - institutional investors can see what retail traders (regular people) are doing on Robinhood. This begs the question:

If Citadel Securities knew what was happening in real-time to stocks like GameStop, why did everyone wait until after the fact to suddenly care?

Because they started losing money.

The Bottom Line

Let’s Break it down:

Stock got shorted

WSB started pumping the stock by buying and holding

Big investors like Citadel, are potentially front-running

Stock goes up, up, up

People that are short (hedgefunds) are forced to cover and buy more stock

Stock is squeezed to infinity

And suddenly GameStop is worth $500.

The Aftermath

As I write this, certain things have happened that are simply wrong:

Trading platforms (not just Robinhood) were down and restricting trades on these stocks. They argue it’s to protect the investor. If I am unable to buy or sell a stock, the stock will fall because the value is given from the purchase. As the stock falls holders lose, but those who are short win.

Reddit tried to take down r/wallstreetbets. This is problematic because there is nothing wrong with posting what stock you want to buy and what strategy you’re following. Do you know what’s wrong? Inciting violence - which there’s plenty of across Reddit. Consider this, it took Reddit 5 years to take down r/The_Donald. A subreddit filled with racism, misogyny, antisemitism, glorification of violence, and conspiracy theories.

CNBC calling out “dumb money”. Everyone in finance is an expert until they start losing money. Not only do the anchors on CNBC constantly insult retail investors by calling them dumb money, but they also complain about their decisions when big players start losing money.

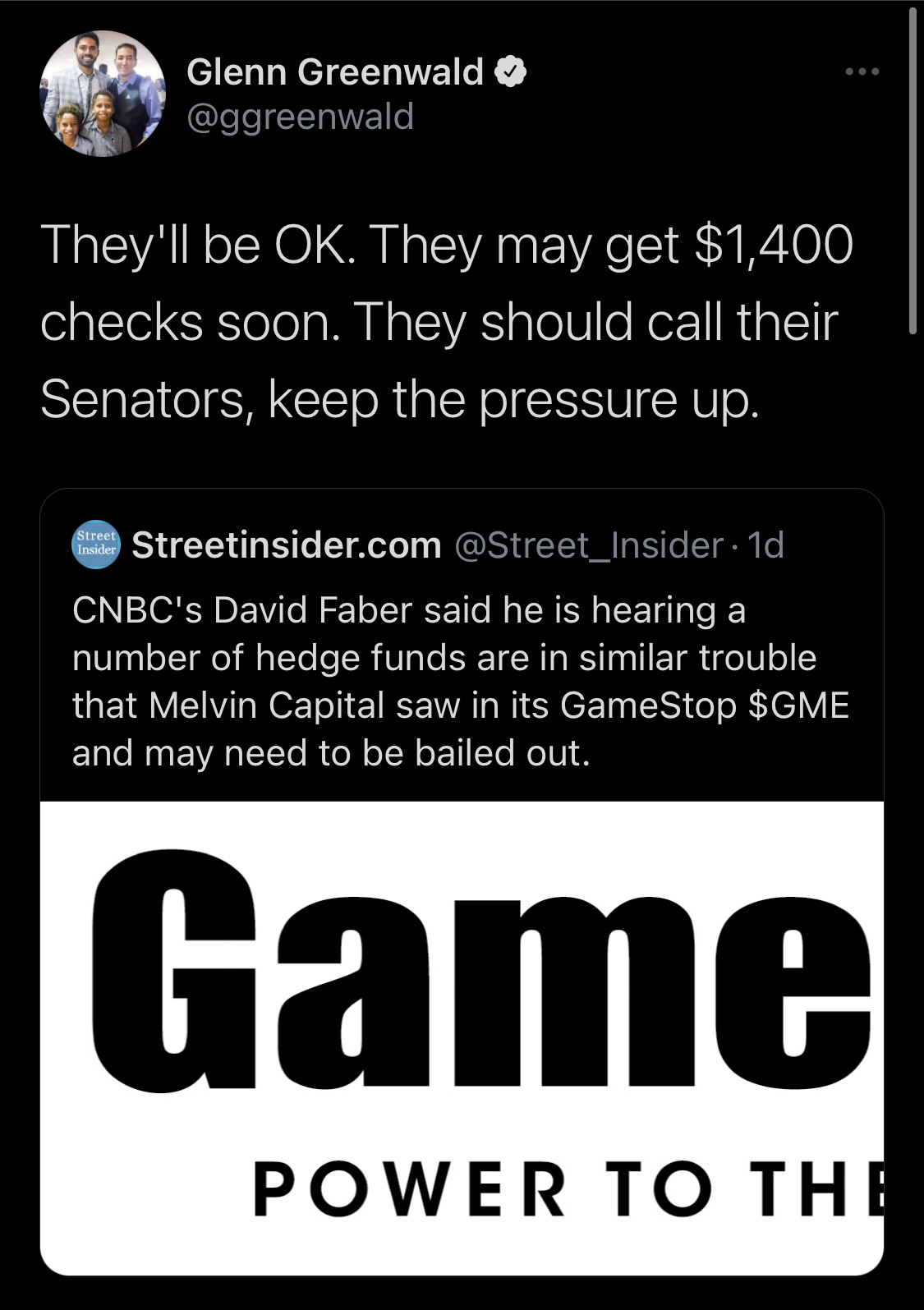

Some fascinating tweets about the whole thing:

Thank You

Can you believe AOC and Don Jr are on the same side? This article is both to explain what’s been happening in the market lately, but also to shed some light on where the line is for tough decisions. You can scream foul play all you want, but companies and regulators will take swift action when the money is involved. When retail investors lose money, everyone says “well they should’ve known the risks.” However, when Melvin Capital loses money, they file a complaint with the SEC. I think’s safe to assume that Hedgefund Managers study some finance. So they should know the risks of playing the game.

As always, if you have any questions or still want more explanations, comment below, follow me on Twitter, or shoot me an email.

Loved this! This story reads like a novel. I’m enjoying a vicarious thrill from seeing the underdog triumph over Goliath. Welcome to the casino, Goliath.